Subprime – bad interest rates (for those with bad credit)

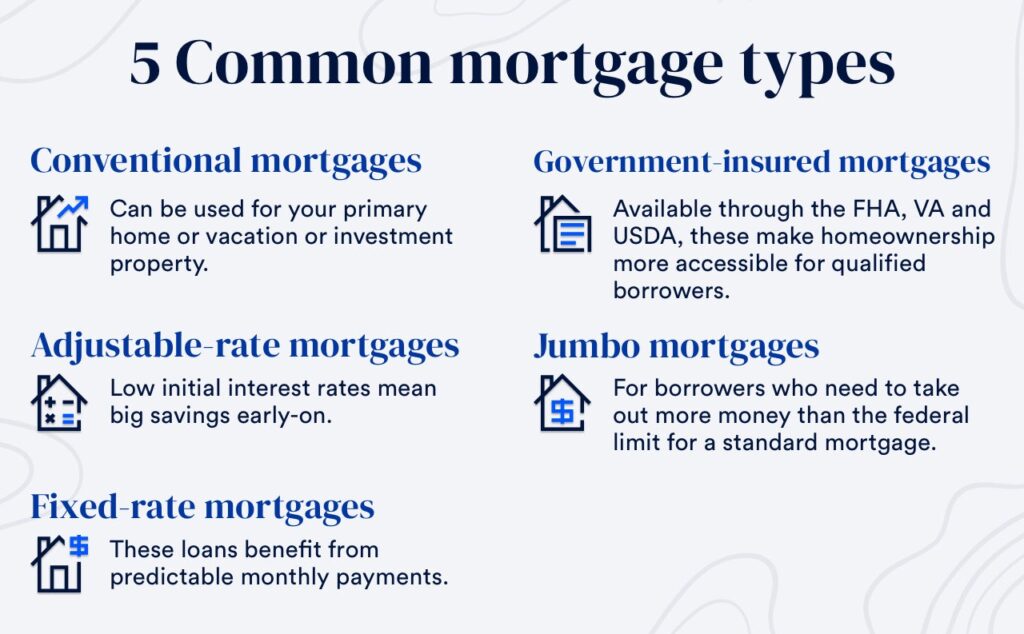

Conventional

- Backed by a bank

- Higher down payment

- Higher credit score

Unconventional

- Lower down payment

- Backed by the gov

- More risk

- Lower credit score

FHA

- Can be as low as 3.5% down (for first time home buyers, need to live in prop for at least one year)

- 30 year fixed (remember the less put down, the more you pay because of interest)

- MIP (mortgage insurance premium) MUST be paid for the entirety of the loan

- Usually have higher interest rates (more of a risk for the lender)Some offers might not be taken as seriously (especially for investors)

VA – for qualified veterans

- 0% down payment

USDA

- 0% down payment

- Prepayment penalties

ARM Loans – Adjustable Rate Mortgage

- Not recommended but can be useful in some situations (a quick flip)

- Better for short term

- May be only option for commercial properties

Non-Conforming Vs. Conforming

Non-Conforming: Doesn’t follow Fannie Mae or Freddie Mac guidelines EX: jumbo loan (loans above a certain amount)

Conforming:

- More common

- Better rates

- Lower down payment

- Private Mortgage Insurance (PMI) – once you pay off at least 20% of the home, you no longer have to pay PMI (keep in mind the insurance is for the LENDER, so if can avoid this, do so)